How To Choose The Best Card Machine For Your Business

Megan

26 Jun, 2023

Do a quick Google search for ‘card machines’, and you’ll be presented with a wide variety of options. It’s no longer only traditional banks selling card machines, but local fintechs as well. And for good reason: according to a Mastercard survey, 79% of South Africans still believe that using a debit or credit card is the most secure way to pay.

While you might be tempted to head out and buy the first machine you stumble upon, it’s best to do your research first.

The right card machine will not only make it easier for you to accept payments, but it should also decrease the amount of time you spend calculating your daily sales and reconciling your books.

But with so many options available, how do you find the best one for your business?

You’ll want to choose a card machine that is not only suitable to your budget but has the features you need to enable your business to succeed.

Read more: Good advice: 6 tips for aspiring small business owners

We compiled this list of common card machine features to help you decide what you need for your business.

12 things to consider when selecting your card machine

1. Portability: Where you do business will influence the type of card machine you should purchase. Do you operate at markets or travel to customers to do business? You’ll want to look for a portable card machine that is battery-operated. This will allow you to accept payments wherever you do business. If you manage a restaurant and customers pay at tables, you’ll also need a device that functions without needing to be plugged into the wall.

2. Payment types: The rise of payment methods like Apple Pay and Google Pay Tap has led to consumers having more choices when it comes to their preferred payment method. To ensure you’re able to close every sale, it’s important that you’re not only able to accept physical card payments but can process cards loaded onto alternative digital payment tools. Find a card machine that can accept tap, swipe, insert and scan payments.

3. Connectivity: There’s nothing worse than losing connectivity while you’re trying to process a sale. When searching for a card machine, look for one that connects to WiFi but also comes with a SIM card. This way, you will always be able to process a payment whether you’re in an area that has Wi-Fi or not.

4. Ease-of-use: Running a business is tough enough without having to spend hours learning a new tool. Find a card machine that’s simple to use and doesn’t require extensive training. The last thing you want is to slow down a queue because you’re struggling to figure out how your payment tool works.

Read more: 6 factors you should consider when starting a business

5. Payment speed: During your business’ peak hours, the last thing you need is a payment process slowing down your service. The longer customers have to wait, the more frustrated they’ll be. Find a card machine that processes payments in seconds so you can swiftly move from one customer to the next.

6. Cost: There are two types of costs associated with purchasing a card machine. The first is the price of the hardware. This is a once-off cost you’ll pay to own the device. The second type of cost is the fees you’ll pay on a continuous basis. This can include processing fees, monthly fees and settlement fees. While each service provider will charge a processing or transaction fee, not all of them will charge a monthly or settlement fee.

While the upfront cost might be small, make sure to check all the other costs that your potential service provider charges. Once you know what these are, you can determine if the monthly cost is suitable for your budget.

7. Rent vs own: While some service providers let you purchase a card machine to own outright, others offer a rental service. If you’re using the card machine in your business long-term, it might be more cost-effective for you to own the device. If you opt to rent instead of own, be sure to check out what the contract involves and if there are any additional fees associated with it.

8. Transaction history: Quick access to your transaction history can help you keep track of your individual payments. It can also simplify your reconciliation process. While some card machines come with an on-screen transaction history allowing you to check your transactions on the same device you use to accept them, others don’t offer that functionality. Instead, you’ll either need to log in to the service provider’s online portal or wait for your transaction history to be emailed to you daily, weekly or monthly.

9. POS Integrations: If you’re a brick-and-mortar store or restaurant that uses a point of sale terminal in addition to your card machine, you’ll need your card machine to ‘speak’ to your POS terminal. Make sure both systems are compatible with each other before purchasing your card machine.

10. Receipts: Does your business still rely on printed receipts? You’ll need to find a card machine that comes with a built-in printer. Alternatively, there are other devices that are paperless and have a digital receipts feature, which allows you to send a receipt to customers via sms or email.

11. Tipping: Does your business accept tips for services well rendered? Find a device that allows you to add tips to your transactions. This not only makes it easier for customers to tip you but also for you to calculate what proportion of your income is from sales and what is from tips.

12. Customer support: Whether you need help setting up your device or you’re having trouble with a specific payment, you’ll most likely need assistance from your service provider at some point. Determine how they provide support and if that suits your needs.

Do you need to log a ticket through their website, or can you call or email and receive direct support? When you’re in a bind with your card machine, the type of support you receive could be the difference between losing out on a few days of sales or continuing in no time.

Read more: 4 easy ways to have authentic interactions with your customers

Use this list of features as a checklist to determine whether the payment tool you’re eyeing will be the right fit for your business needs. Buying the right card machine will save you money in the long run and also provide your customers with a satisfying experience.

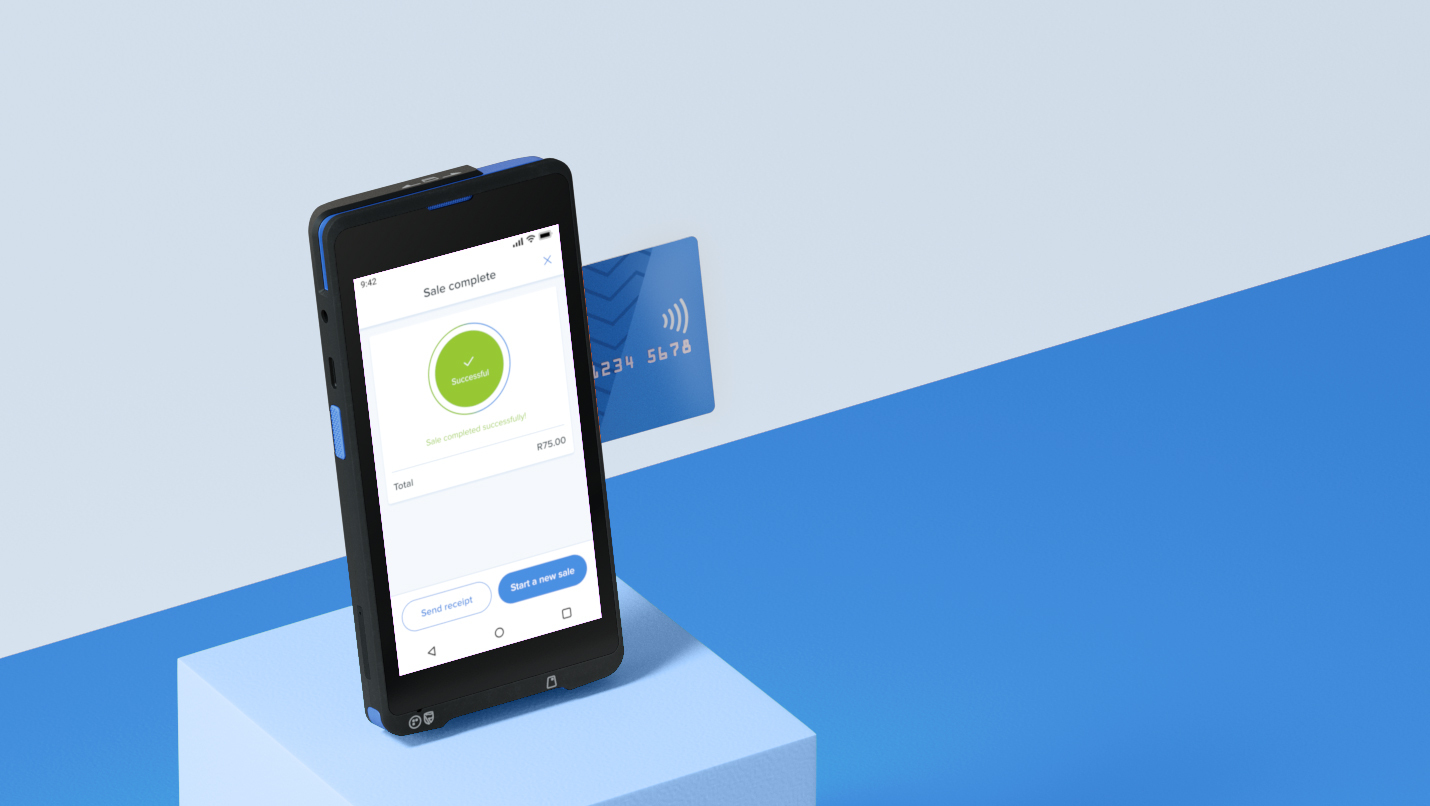

Introducing the SnapScan card machine

Ready to purchase your first card machine? Consider purchasing the SnapScan card machine.

Developed in partnership with Standard Bank, this snappy new card machine allows businesses to make sales and manage their business the way they want to.

The SnapScan card machine functions like a smartphone. The standalone device is WiFi-enabled and comes with a SIM card loaded with free data.

With the SnapScan card machine, businesses can accept all payments on one device. Customers can tap, insert or swipe their Mastercard and Visa bank cards, scan the on-screen QR code with SnapScan and Masterpass apps or tap their mobile devices using Apple Pay, Samsung Pay and even Garmin Pay.

Plus, since you’re spending less time switching between payment tools, you’ll spend more time satisfying your customers.

Get yours for R999.00 (once-off) here.

Related articles

10 side hustle ideas you can turn into a small business

Use your skills to help you earn some extra income

6 ways SnapScan can help your business collect payments

Get paid in a snap with our range of payment solutions.

8 communication tips for success in sales

Effective communication is a key component in securing sales and building rapport.