6 ways SnapLinks can help you process online payments faster

Megan

17 Aug, 2022

If there’s one way to encourage your customers to pay quicker, it’s to provide them with a hassle-free way to pay you. By sending them a SnapLink, you’ll be doing just that.

Formerly known as Pay Links, our SnapLinks are an easy, seamless way to collect payments from your customers. You don’t need to be an expert web developer to use them – all you need to do is copy and paste; it’s that simple!

So what is a SnapLink? A SnapLink is a link you send to customers when you want them to pay you. When customers click your SnapLink, they’re taken to a secure payment screen where they’ll instantly be able to make a payment. Since SnapLinks work on mobile and desktop, your customers can pay from whatever device they’re using when they receive your link.

Read more: An essential guide to online marketing for small businesses

Not only are SnapLinks easy to use for you and your customers, but they can help you streamline your payment process. Here are six ways how:

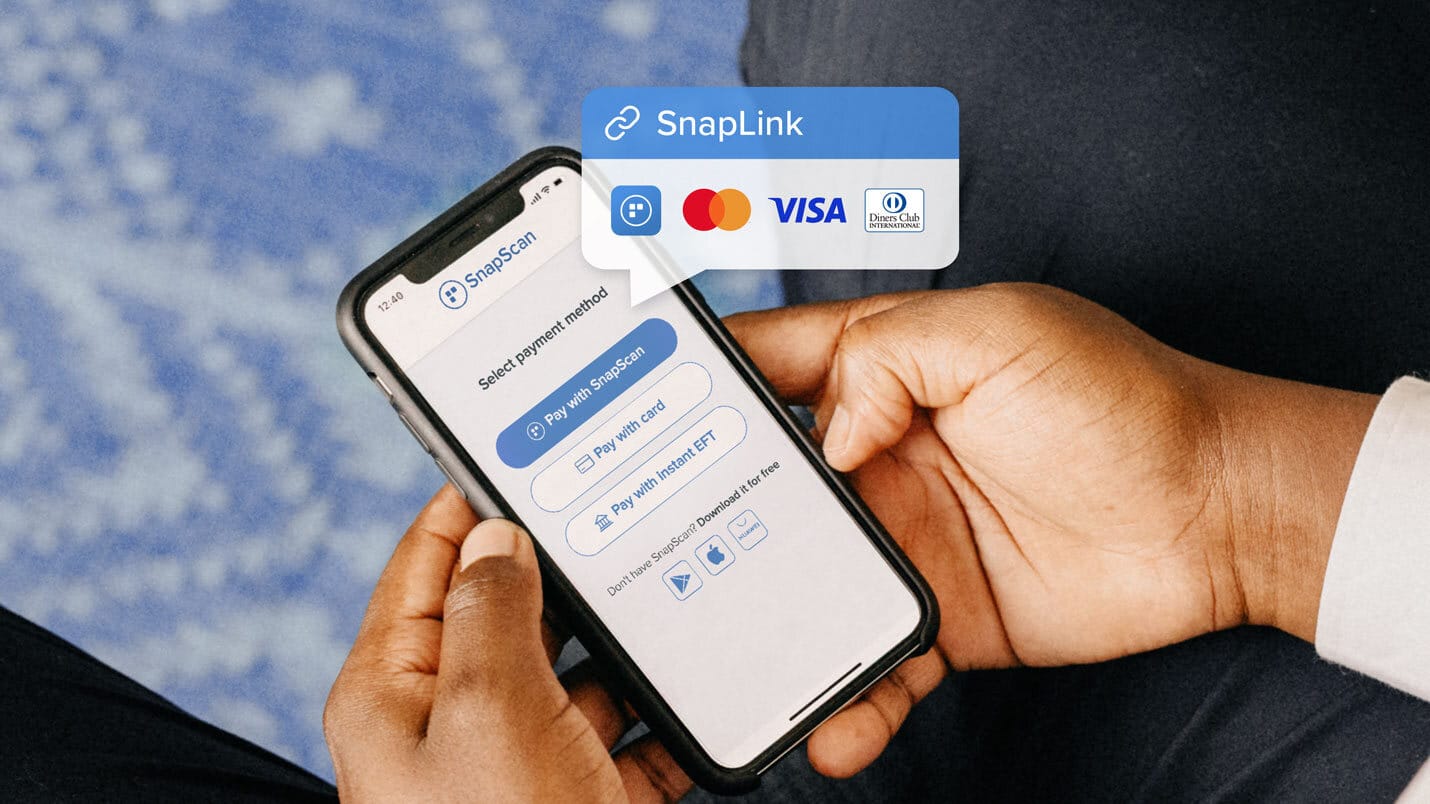

1. SnapLinks offer your customers three ways to pay

When it comes to payment methods, most consumers have a favourite. While some consumers prefer to pay by card, others prefer to pay using Instant EFT.

With a SnapLink, customers can pay using:

1. Their SnapScan app,

2. their bank cards, or

3. via Instant EFT.

Pizza franchise Butler’s Pizza sends a SnapLink to their customers after they’ve placed their order. Those without the SnapScan app can pay by entering their bank card information or logging in to their bank account directly from your SnapLink. It’s an easy, hassle-free way for customers to pay for their orders.

It also means that the Butler’s delivery team doesn’t need to worry about handling cash or dealing with fussy card machines when they drop off their customers’ orders.

Bonus: Our Pay with card feature accepts all Mastercard, Visa and Diner’s Club cards, which means you can also accept payments from international customers.

2. You can accept payments online without a website

Setting up an online business has never been easier, thanks to social media platforms like Instagram, Facebook and WhatsApp. Direct messages allow customers to place an order with you in just a few steps. In turn, you decide how you want to collect payments.

With a SnapLink, you’ll make the payment part of the transaction easier for you and your customer. No need to switch platforms; simply send your payment link to customers wherever you communicate with them.

Small business owner, Corli du Toit, runs an ecommerce store, Yoyos 4 Africa. Although many of her customers place orders via her website, numerous others message her directly. “The SnapLink makes it easy for me to accept payments outside the website, as my customers sometimes place orders via email or WhatsApp,” she says.

Corli can quickly send those customers a SnapLink on whichever platform they contact her. Her customers can then tap to pay for their orders.

Read more: How to market your business using Facebook and WhatsApp

3. It can help get your invoices paid faster

Do you provide a service instead of selling goods? Whether you’re a dentist, plumber, or offer any other service, a SnapLink helps customers quickly pay for your services. They no longer need to copy your details to send an EFT – instead, they can pay by clicking the link. Simply paste your payment link on a digital invoice or include it in your email.

After booking their furry friends into Dog Hotel and Daycare, SUPERWOOF, clients receive an invoice via email. SUPERWOOF’s clients can then pay their invoices by clicking on the SnapLink on the invoice. “Using SnapScan has simplified our payments process and taken the hassle out of using card machines,” says SUPERWOOF’s General Manager, Bianca Couch. “Our clients find it easy to use, resulting in a high payment turnover.”

4. Your payments will be processed instantly

Many businesses need a payment solution that processes payments immediately. Our SnapLinks deliver on that promise.

This works particularly well for Butler’s Pizza. Hungry customers pay for their orders via the SnapLink they received via text. And because payments are processed instantly, Butler’s customers can rest assured knowing their pizza will arrive soon after.

Read more: 16 (mostly) free online tools that’ll help you grow your small business

5. You can keep track of whose paid you

For small businesses like Yoyos 4 Africa, knowing when a customer has paid is incredibly important. Our SnapLinks come with a referencing feature which prompts your customers to include the information you need to identify orders.

References appear on your transaction list, making it easy to track who has paid you. It also means that you don’t need to rely on a customer’s proof of payment, as you’ll instantly be able to identify who has paid you.

6. Send a SnapLink anywhere, anytime

With the SnapStore app, you can send a SnapLink wherever you are. Sitting in your car when a customer sends through an order? Quickly send them a payment link by generating one in the SnapStore app. The mobile app helps registered SnapScan businesses manage their payments while they’re on the go.

The SnapStore app will also send you a push notification when a customer pays you. This will help streamline your workflow as you can complete a customer’s order the instant they pay.

Together these six benefits make our SnapLink a pretty powerful tool. Many businesses are already using a SnapLink to get paid in a snap, and it can do the same for you. Don’t have a SnapScan merchant account? Sign up here for a better way to get paid.

Related articles

4 easy-to-use ecommerce platforms you can use to build your online store

Find a platform that suits the needs of your small business.

6 factors you should consider when starting a business

Use these tips to turn your idea into an operating business.

6 ways SnapScan can help your business collect payments

Get paid in a snap with our range of payment solutions.