4 tips to stay safe while shopping online

Aurora

19 November, 2021

Since the start of the global pandemic more South African retailers than ever before have made the move to sell online. It is now easy to order not only clothing and luxury items online, but everyday products such as groceries and other essentials as well.

This shift is healthy for our economy and our quality of life but has also seen a surge in the number of consumers shopping online for the first time, many of whom are not aware of best practices for card and personal data security. With Black Friday on the horizon, it is anticipated that these emerging adopters, paired with the growth of online retailers, will see an increase on top of the typical boom in sales.

Read more: 6 incredible non-profit organisations you can support in a snap

Without being alarmist, fraudsters are well aware of the opportunity that this presents to them, so it’s worth brushing up on your online payment security regardless of your familiarity with online transactions.

Use these tips to make sure you’re protected from fraudsters when shopping online this Black Friday.

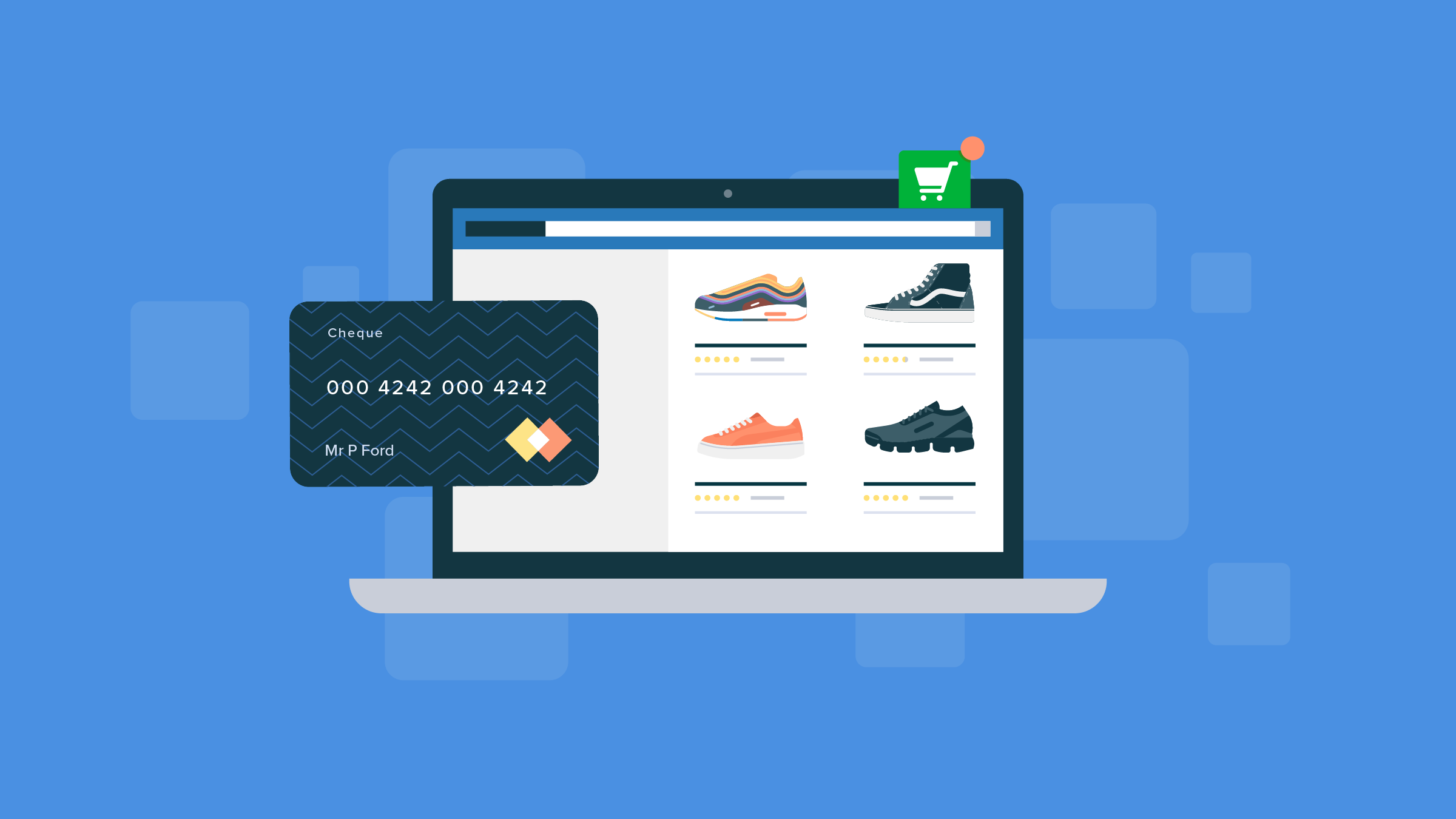

1. The golden rule: protect your card details

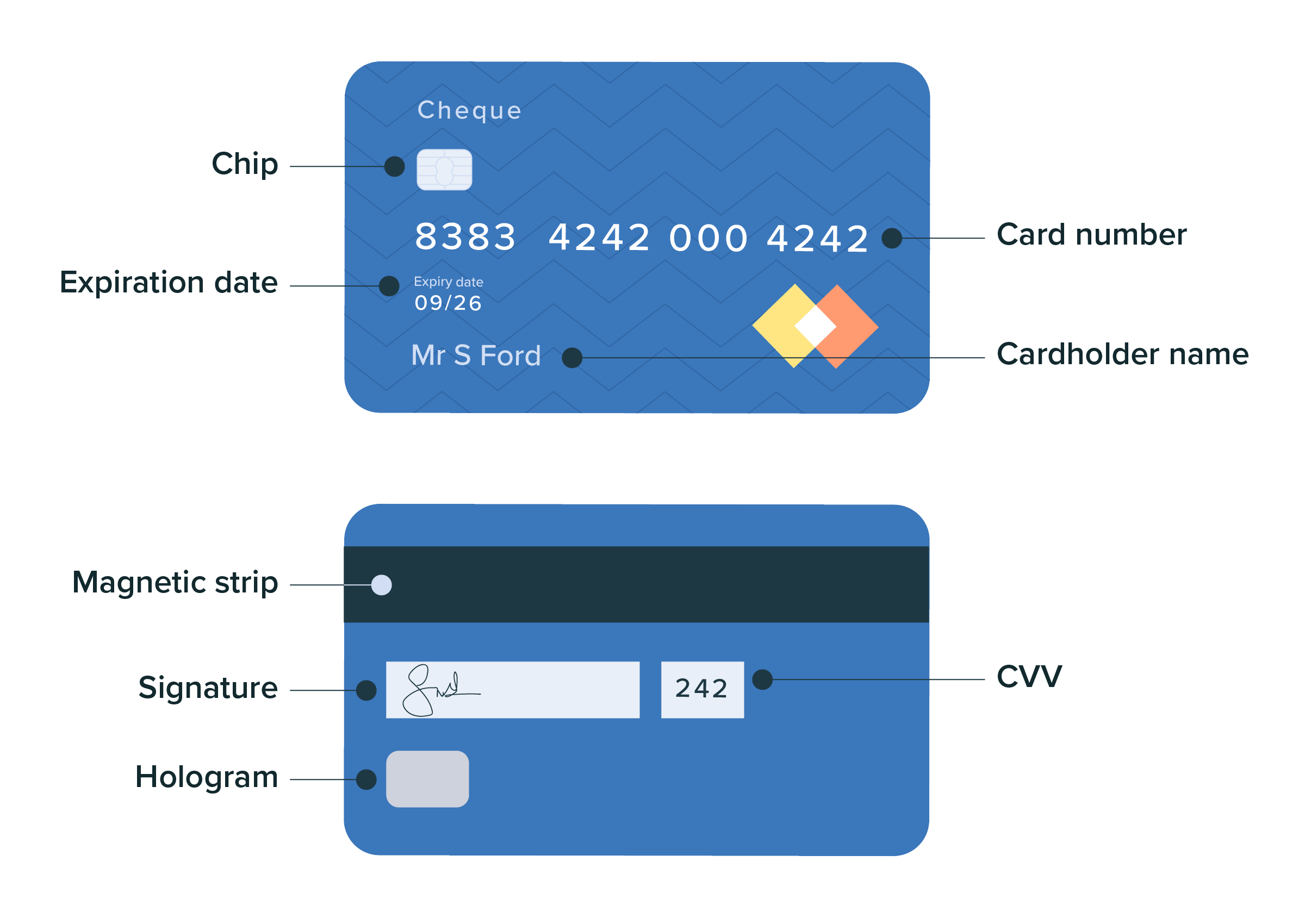

There are three pieces of card information that you need to protect.

- The card number or PAN (Primary account number): A unique 14 to 16 digit number that your bank associates with your account specifically

- The expiration date: The month and year that your card is set to expire, in the format MM/YY

- The CVV (card verification value): the three digits on the back of your card

Much like you would never give a stranger your physical bank card and allow them to walk off with it, you should never disclose these card details to anyone, as they are – nearly – all a fraudster needs to be able to make payments from your account.

In nature, Aggressive Mimicry is a predatory behaviour in which an animal takes on a docile or alluring appearance to deceive their prey into lowering their guard, leaving them vulnerable to attack. In banking, Phishing is the name of a similar practice – fraudsters attempt to impersonate your bank or other financial institutions via SMS, email, or phone call, to trick you into giving them your card details.

The reality is that no person or institution, not even your own bank, will ever request this information from you. Any time that someone coerces you into divulging your card details, you can assume they are trying to defraud you. Make sure to never give this information out – ever!

But if you aren’t supposed to reveal your card details at all, how can it be safe to enter this exact information while shopping online? Payment gateways have both a moral and business incentive to follow the necessary protocols that ensure that your card information is safe.

Read more: The SnapScan Wallet: the digital account you didn’t know you needed

Below are some additional measures you can take to reduce the risk of your details being compromised:

2. Seek out security

Always ensure that the URL of the website you are purchasing from starts with HTTPS, not just HTTP. The S stands for “secure” and indicates that the information being transferred is encrypted – there will be a small padlock to the left of the URL if this is the case. This ensures that your card details remain confidential and can’t be deciphered into plain text by a third party. This is super important.

3. Personal data hygiene

Resist the appeal of the Save Card Details option. While it is enticing to skip typing out your card details each time you buy something online, there is a possibility that the company who has your card on file experiences a data breach.

You can avoid this repetition by using the SnapScan app – you’ll only need to load your card once, after which it will be available to use for future transactions. We encrypt your card data when you load it, so your full card details are not available in plain text.

Read more: More than QR codes: how to pay with your SnapScan app

By spreading your information across a variety of platforms and websites, each with their own individual vulnerabilities, you are accumulating a lot of risk. Entering your card details on only the SnapScan app still allows you to make purchases in multiple places, but without adding new risk each time.

4. 3D secure – a necessary nuisance

3D Secure is an added security feature required for online transactions. It aims to authenticate that the person making the purchase and the actual cardholder are one and the same, as opposed to a fraudster who has obtained someone else’s card details.

Familiarise yourself with your specific 3D secure process ahead of time, as it can differ per bank and card. Ensuring that you know what to expect will lead to smoother, faster payments, helping you to secure those time-sensitive Black Friday deals.

Ultimately, whether you’ve been waiting to snap up an expensive item that is finally going on sale or you’ll be at the virtual frontline fighting for the best products on offer, we hope that these tips make your Black Friday slightly less stressful, and much safer.

Related articles

More than QR codes: how to pay with your SnapScan app

From QR codes to in-app donations. Use the SnapScan app to make easy payments.

4 tips to easily optimise your online store

Is the cart becoming the new Wishlist?

Payment Links: making remote payments quick and easy

If there’s one thing your customers won’t say no to, it’s convenience.