The SnapScan Wallet: the digital account you didn’t know you needed

Megan

28 Jul, 2021

We can think of several good ways for you to spend your free time: binge-watching series on Netflix, catching up with friends over dinner, or even celebrating a milestone with your team over (virtual) drinks. Figuring out how to repay your friend for last night’s dinner is not one of them.

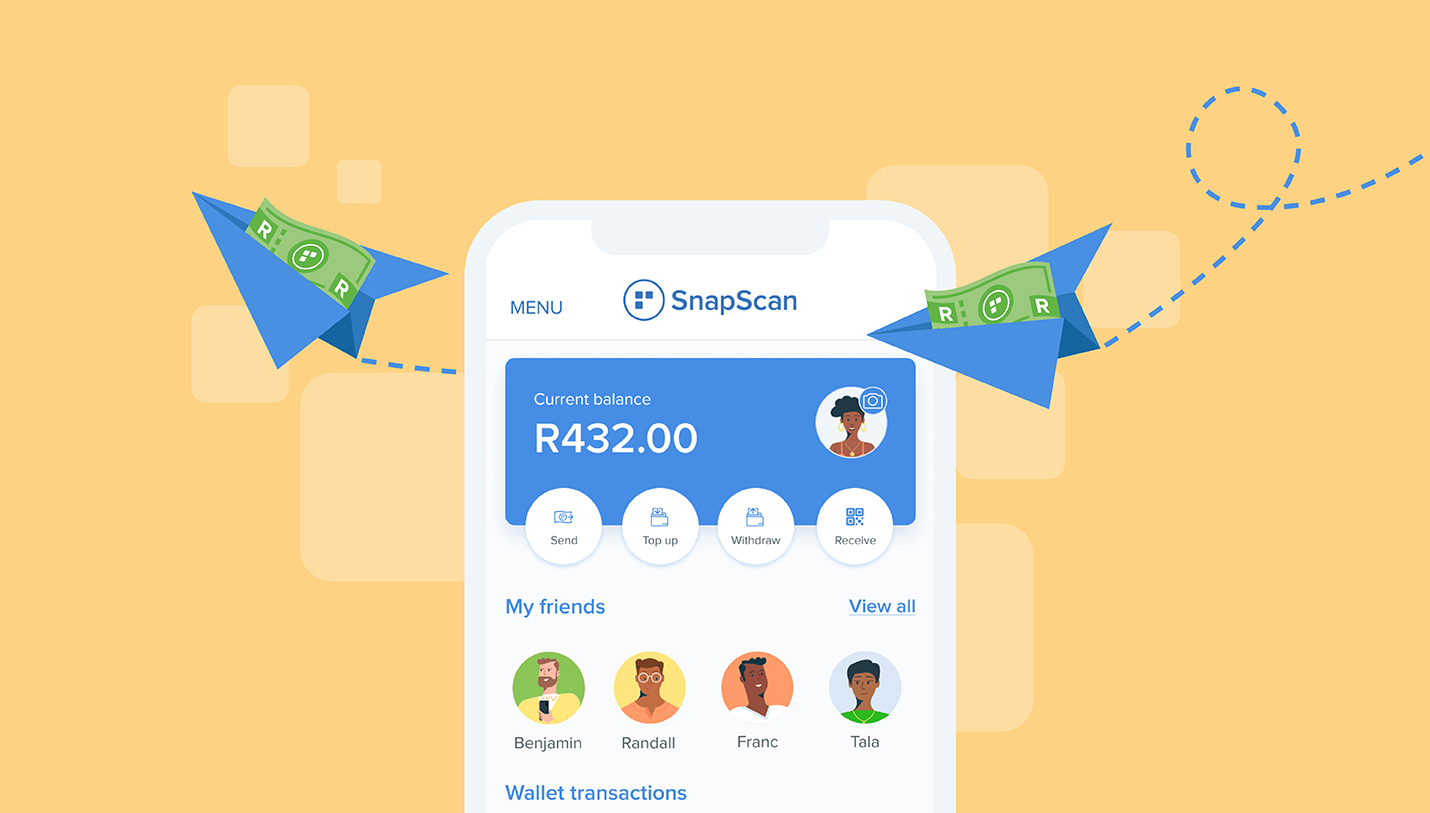

That’s where the SnapScan Wallet comes in. Situated in the SnapScan app, the SnapScan Wallet functions like a digital bank account. Instantly send money to a friend’s Wallet or top up your own Wallet and use it as a budgeting tool. Money in the SnapScan Wallet can be used at any business that accepts SnapScan, or even within the SnapScan app.

Read more: More than QR codes: how to pay with your SnapScan app

Send money in a snap

The most tedious thing about repaying a friend via EFT is having to load their bank details. With SnapScan, sending money to a friend’s Wallet is a quick and easy process. Get started by pressing Send in the Wallet section. You’ll then be prompted to connect with your friend by sending them a link or scanning their QR code. Once you’re connected, you can send them money in a snap. This means your friend will instantly see the money you sent reflected in their SnapScan Wallet.

An early fan of SnapScan, Digital Manager and Content Editor, Alex Isaacs, appreciates the convenience of the SnapScan Wallet. “I like the convenience of the Wallet, and how easy it is to use,” Alex explains. “I like it much better than using hard cash or my bank card, because the first is not Covid-safe and because I often forget [my card] in my wife’s bag or lose it. It’s also a lot safer.”

Alex first discovered the SnapScan Wallet when their colleague stumbled across it and asked them to figure out how to use it. The Wallet soon became integral to Alex and their colleagues’ lunch plans. “We used to eat together about once a week,” they explain. “We love getting bagels, and New York Bagels accepts SnapScan, so we could all send money to one colleague and she would buy them for us.”

Once you send money to someone, they’ll automatically be saved in your app as a friend. The next time you want to send them money, all you need to do is click on their name. It’s like setting up a beneficiary in your banking app, without the hassle of inputting their bank details.

Business Analysis & Intelligence Specialist, Byron Ferreira, has been on both the sending and receiving end of SnapScan transactions. Being able to instantly send money to someone else has made his office coffee runs a lot simpler. “I like that you can store ‘friends’ for easy future payments,” Byron says. “The age of cash is antiquated and these features just make the usage and movement of money so much easier.”

Budget your expenses

Read any article about financial advice, and the term you’ll see used most often is ‘budget’. That’s because having a budget is a great way to stay on track of your financial goals. Regardless of what your goals might be, the SnapScan Wallet can help you stay on track.

Along with sending money to friends, both Alex and Byron use the SnapScan Wallet as a budgeting tool. “I break up my monthly budget into ‘essentials money’ and ‘fun money’, says Alex. “If it’s in the SnapScan Wallet, I know I can use it for fun. I’ll spend it on anything from snacks, to giving to charity, or even gambling.”

Long before Byron discovered he could send money to friends via the SnapScan Wallet, he used the Wallet to manage his expenses. “As charges became reoccurring, in terms of where I would find myself using the app most often, like getting coffee with colleagues, I found that I could smooth my expenses over the month by topping up [my Wallet]”, he explains. To prevent himself from overindulging on his favourite treats, Byron would only purchase them using the funds in his Wallet. This also helped him stick to his budget.

While he mostly budgets for regularly occurring expenses like coffee, snacks, and electricity, Byron also treats his Wallet like a savings account. “When I really wanted to buy a large ticket item from a store that accepted SnapScan, I would top up the wallet over a few months in order to make the purchase when I was able to do it more comfortably,” he explains. “That way I wouldn’t feel the pinch of the credit card interest that could have happened if I simply purchased it on day one.”

Read more: Silence the beeping meter: recharge electricity in a snap

Over time, Byron’s use of the Wallet evolved from ‘nice to have’ to being a necessity to control the way he uses money. “I would be very lost without the Wallet feature from SnapScan,” he says. “My biggest love of the Wallet is definitely its ease of use as well as its ability to help me budget my expenses.”

Unlock more features

Thanks to some exciting new updates the SnapScan Team has made to the Wallet, you can now do more with the funds in your SnapScan Wallet. If you possess a South African ID document and have access to a supported bank account, you’re now able to verify your app.

Verification is a once-off process that lets you send money from your Wallet to a friend’s Wallet. You’re also able to withdraw the money in your Wallet to your linked bank account. There’s just a 3.5% charge whenever you withdraw money.

Ready to make the most out of your SnapScan Wallet? Update your app to the latest version (Android or iOS) to take advantage of all these exciting features.

Related articles

More than QR codes: how to pay with your SnapScan app

From QR codes to in-app donations. Use the SnapScan app to make easy payments.

Silence the beeping meter: recharge electricity in a snap

Is 500m far enough to justify ordering a taxi so you can go to a...

Fabricate: supporting local designers

Fabricate champions locally made products, and supports designers starting out.