A guide on invoicing for small businesses

Megan

26 July, 2021

A steady cash flow is essential for any small business to operate effectively. It’s one of the reasons why keeping track of your finances is important. The last thing you want is for your business to come to a standstill, because you’re still waiting for customers to pay you. Ensure you get paid on time by sending your customers an invoice that is easy to pay.

Sending out invoices can seem like a long and tedious process. But it’s a necessary step to ensure the lights stay on. Not only will sending out invoices help you collect payments faster, but it will help you manage and keep track of your payments. It also provides you with a legal document you can point to, if you struggle to collect payments from customers later on.

Unsure of where to start? We’ve put together this handy guide with several invoicing options.

Read more: In good company: deciding how to structure your business

Things to keep in mind:

Make sure your customers know your rates and payment terms ahead of time. Send them a quote (an estimated cost of your services tailored to their needs) before you start work to avoid any conflicts that may arise when you send through your invoice. This ensures that there are no payment delays. Inform your customers about any fines or penalties they will incur if their payment is late. If you require an upfront deposit, let them know beforehand.

Timing is everything. When you send an invoice is incredibly important. Ideally you should send it as soon as the goods or services have been delivered or completed. This way you can avoid issues with your cash flow.

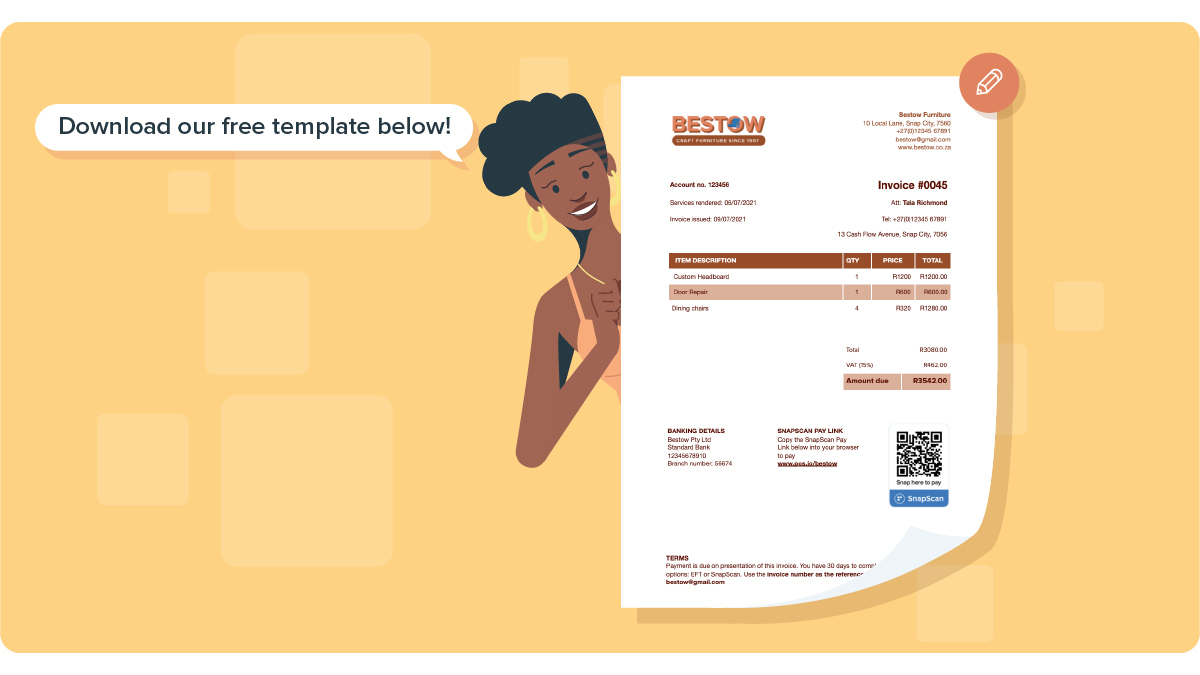

Create an invoice from scratch

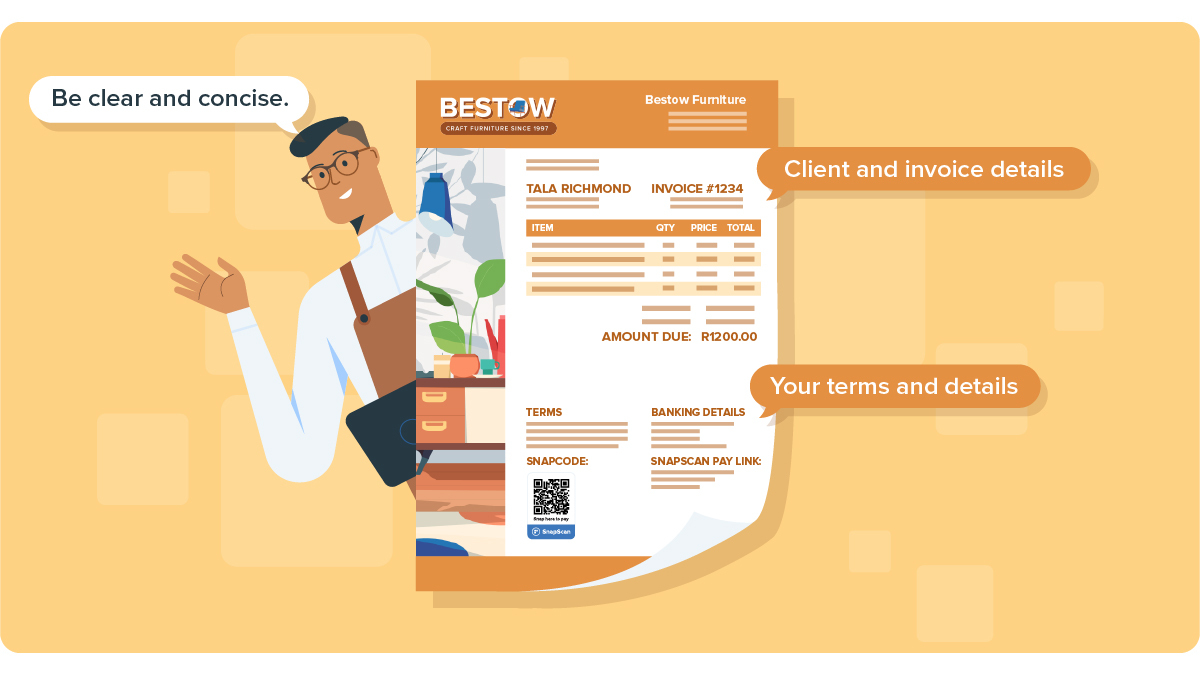

Invoices are not just about showing the customer what they owe, but about making it easier for them to pay you. Make your invoice easy to read and understand.

Although no two invoices look alike, they all contain information that’s necessary for customers to make a payment. If you’re creating an invoice from scratch, the following information should be included in your template:

- Invoice number. This will help you keep track of your payments.

- Important dates. Along with the date of issue, include the date of services rendered as well as the date customers need to pay by.

- Company details. Include your company name, address, phone number and banking details.

- Customer information. This is important for your records.

- Item description. Clearly describe what your customer is paying for, and include the price and quantity of each item.

- Discounts applicable. If you’ve offered your customer a discount, list the original price, and then highlight the discounted amount.

- VAT. All businesses registered for VAT should include their VAT registration number, the VAT percentage and the total amount of VAT in rand value.

- Total amount. Add up the amounts of all your line items, subtract any discounts, and clearly mark the total, so your customer immediately knows what they owe. If you’re a VAT registered business, you would need to add your VAT amount to this total and clearly display your new total amount as the amount owed to you by your customer.

- Payment method and terms. Clearly state how and when customers should pay. If your preferred method is an EFT, make sure that your bank details are clear and easy to copy and paste. Include the reference they need to use in order for you to track their payment. Let them know if they need to send you proof of payment.

You can also make it easier for your customers to pay you by adding your SnapCode or a SnapLink to your invoice. Customers can either scan your code or tap the link to pay. This encourages customers to pay you immediately. Not a SnapScan merchant? Sign up here.

Read more: SnapLinks: making remote payments quick and easy

Use an invoice template

Using a template ensures that your invoices stick to a simple and consistent format, which is easy for your customers to understand. Templates are often customisable, allowing you to select colours that align with your brand, and insert your company logo.

One of the perks of using a pre-existing template is that you spend less time creating one, and more time seeing to your business’ needs. Most templates already include sections for the information your customers need in order to pay you. All you need to do is fill this information in.

We’ve created an invoice template to make it easier for you to get started. We’ve even allocated a space for you to add your SnapCode and SnapScan SnapLink. Check it out here.

Level up with cloud-based invoicing software

As your business grows, you might find it difficult to keep track of all your customers. If you have the budget for it, make use of cloud-based invoicing software. This online software simplifies a range of processes that will ultimately reduce the time you spend generating invoices. To start, it stores all your data online, allowing you to easily switch between laptops or even access it from your mobile device.

When creating an invoice for a repeat customer, you’ll already have their details on-hand, cutting down the time you spend filling in their details. A number of software platforms provide automation tools that enable you to set up recurring invoices for repeat customers and automated emails to late-paying customers.

Cloud-based invoicing software also allows you to include multiple payment options, making it easier for your customers to pay you.

Here are six factors you should consider before purchasing cloud-based invoicing software:

- Cost. What services does the price include, and how does it fit into your budget?

- Scale. As your business grows, are you able to access new tools that will support your growing needs?

- Ease of use. Is it user-friendly? Can you easily figure out how to use it?

- Access. How many staff members are able to make use of the software?

- Compatibility. Does it cater to your language and currency requirements?

- Payment Gateways. Does the software offer payment collection options that correlate with how your customers prefer to pay you.

Want to add your SnapCode of SnapLink to an invoice? SnapScan currently has full integration with cloud-based software, Sage Accounting. You can also add your SnapCodes and SnapLinks manually. Contact our team at help@snapscan.co.za if you need help setting it up.

Following up with a statement

Sometimes, despite your best efforts, your customers will pay you late. There are many reasons for this. They could be having issues with their cash flow, the person who does their payments is on leave or your email fell through the cracks.

To remind your customers of unpaid invoices, send them a statement to follow up. A statement is a summary of what the customer owes. It includes a list of all invoices that are unpaid, or only partially paid, as well as the total amount they owe.

Most cloud-based software comes with the function to send monthly statements, but you can also use a template, if you’ve opted not to use cloud-based software.

Ultimately, there is no one-size-fits-all solution when it comes to invoicing. There is however a ‘best fit’. After considering your business needs, choose the solution that is best suited to meeting those needs.

Related articles

10 side hustle ideas you can turn into a small business

Use your skills to help you earn some extra income

6 tips for the perfect email marketing strategy

Up your email game and increase your ROI

8 things you should consider when creating an online store

Creating an online store doesn't have to be an overwhelming experience.