How to get funding for your small business

Megan

8 Jun, 2022

There’s a saying that goes, ‘The only two certainties in life are death and taxes.’ We’d like to propose a third: you need both time and money to grow your business.

While you may have time on your hands, your business will quickly come to a standstill if you don’t have the funds to pay for all the expenses you may incur.

This is where business funding comes in.

In the past, unless you could put together a solid proposal to apply for a loan at the bank or knew someone who could loan you the capital, your dream of growing a business would remain a pipedream. Now, with the rise of different types of funders, you can turn your dream into a reality. Not only are there alternative funding solutions, but a plethora of funders have cropped up over the years all with the goal of helping small businesses succeed.

In this article, we’ll explore:

- Types of funders you can approach

- What you should consider before applying for funding, and

- Funders you can turn to, including: Xena, Small Enterprise Finance Agency, Merchant Capital, National Youth Development Agency, Lulalend, FinFind and more.

Read more: 6 factors you should consider when starting a business

Types of funders you can approach

As mentioned previously, there are different types of funders. They all have set requirements and will provide you with capital in exchange for specific things.

1. Government grants

Many government grants are available for entrepreneurs looking to start or grow their businesses. While you won’t have to repay some grants, others require a percentage to be repaid. It’s therefore imperative that you read the fine print.

Government grants often have pretty strict criteria that need to be met for businesses to successfully obtain funding from them. Grants are often given to businesses that contribute to the economy and create jobs for others. In addition, many grants are usually given to previously disadvantaged individuals, including black-owned, women-owned or youth-owned businesses. There are also grants for persons with disabilities.

The type of grant you apply for is often based on which industry your business falls into. To ensure your application is successful, apply for grants that cater to your specific industry.

2. Small business loans

There are two ways to secure a loan to fund your business. You can either approach a bank or an alternative lending institution for financing.

While banks are the most well-known lending institutions, securing a bank loan can be tricky. Banks usually loan money to businesses with a history of turning a profit or who can provide a business plan which clearly states how they will make a profit.

In recent years, alternative lending institutions have popped up. Thanks to their simple application process, it’s often quicker and easier to receive financing through these alternative funders. You’ll also know within days whether your application is successful or not.

3. Equity funding

In exchange for an investment, equity funders receive a percentage of ownership in your business.

There are two types of companies that provide equity funding: private equity firms and Venture Capitalists. While Private equity firms often buy into well-established companies, Venture Capitalists will invest in start-up businesses.

Unlike other lending institutions, you won’t have to repay equity funders every month. These companies only make money when the business does. They’ll receive a percentage (which both parties have agreed to) of your profits. Alternatively, they can sell their shares to another funder.

4. Angel investors

If you have friends, family or a mentor who has the resources to fund your business, you can turn to them for financial support. Like equity funders, Angel Investors will receive a percentage of ownership in your business and will only get paid when your business begins to turn a profit.

5. Crowdfunding

Crowdfunding has become increasingly popular. When you use a crowdfunding platform to raise capital for your business venture, you’ll give your contributors a gift in exchange for their funding instead of repaying your investors.

This gift can either be one of the products you’ll produce, or you can create something special for investors. The type of gift you give to investors can also differ based on their contribution. Those who invest more will often receive a more expensive gift than those who contribute less.

Read more: Good advice: 6 tips for aspiring small business owners

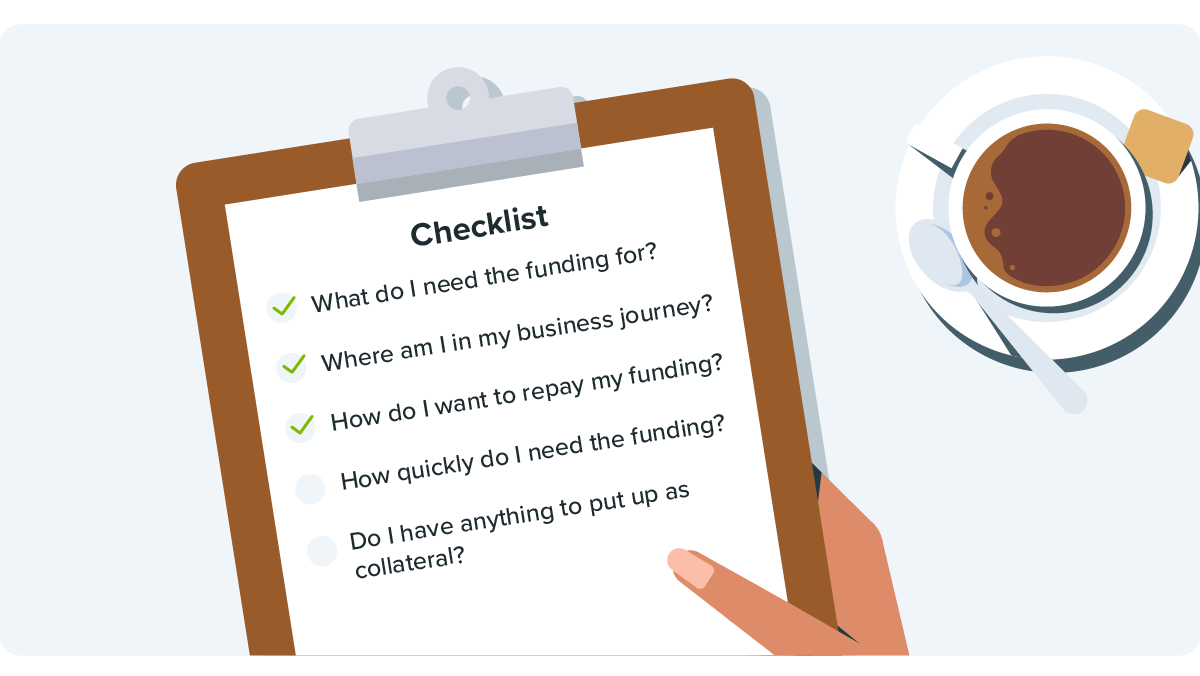

Things to consider when applying for business funding

- What do you need the funding for? While some types of financing, like a cash advance, are open-ended and can be used on any of your business expenses, other types, like Asset or Equipment Finance can only be used to purchase assets or equipment.

- Where are you on your business journey? If your business has yet to begin trading, the funding sources you can approach are limited. Your best bet is to apply for a government grant, or if you’re able to draw up a great business plan – you might find some luck approaching a bank. If you’ve been trading for a few months, you’ll need to check the requirements of alternative lenders before applying. While some allow you to apply after six months, others require you to be trading for at least a year.

- How do you want to repay your funding? If you don’t think your business will be profitable in the near future, you might want to apply for a grant, or if you’re happy giving up a portion of ownership, you could look into equity funding. If you can make repayments, check the repayment terms of funders to see which ones match how you’re able to make repayments.

- How quickly do you need business funding? While alternative lenders can provide you with capital within 48 hours, banks and government grants will take longer. The latter both have long processes, which include submitting a mountain of paperwork, potential interviews to plead your case and then waiting for a couple of weeks to receive feedback.

- Do you have anything to put up as collateral? Alternative lenders and government grants provide unsecured funding, so you won’t need to put up collateral. However, since banks are risk-averse, they’ll need something in return in case you default on your repayments.

Funders you can approach

Below are a variety of alternative lenders and government grants that you can approach for business funding. They each have their own set of requirements, so it’s important to look at each one carefully.

While this is by no means an exhaustive list, they provide a good starting point. You’ll also get a good idea of how the application process works and what requirements or criteria you need to meet to apply for these types of funding.

Read more: 9 money management tips to keep your small business afloat

Xena‘s mission is to unlock the potential of the female economy by helping women build strong networks and giving them access to resources that’ll help them upskill. The networking platform also houses a section where female entrepreneurs can apply for business funding.

How it works: Join the Xena community via their App. Once logged in, you can apply for business funding via the app. You’ll receive feedback within hours.

Types of funding: A cash advance

Amount: The amount you can apply for is based on your monthly turnover and the outcome of your application. You could qualify for anything from R30 000 to R5 million.

Requirements: Your business must have been operating for at least 6months. You’ll also need to have R30 000 monthly in card swipes or have received R100 000 in EFTs for six months.

Repayment terms: Your repayment is a small percentage of your turnover. Choose to repay the loan daily, weekly or even bi-weekly – the choice is yours. The flexibility allows you to structure the repayment around how your business operates. Your last repayment will be donated to one of Xena’s affiliated NPOs.

Documents needed: You’ll need six months’ bank statements, a copy of your ID and proof of business registration.

Costs: Xena charges a fixed fee based on your application, which is discussed with you at the beginning. This fee will remain unchanged throughout your repayment term, regardless of how long it takes for you to complete the repayment.

SEFA provides funding to qualifying SMMEs and cooperatives through grants and direct lending products. Its financial products are structured to provide business funding to entrepreneurs to help them grow their businesses.

Some of its programmes, like the Spaza-shop Support Programme and the Township and Rural Entrepreneurship Programme, are structured as partial loans. Businesses that receive funding via these programmes need to repay 50% of what they receive. These all come with strict criteria that businesses need to meet to qualify.

SEFA also has direct lending products, where SMEs and cooperatives can apply for funding between R50 000 to R15 million. These, however, need to be repaid in full.

Below are all the loans available:

- Inyamazane Funding Scheme – This scheme is for South African military veterans who want to start a business. These loans are given at a 9% fixed interest rate and must be repaid within five years.

- Amavulandlela Funding Scheme – This lending facility is for South Africans with disabilities. These loans are given at a prime minus 5% p/a interest rate, with a repayment term of up to 5 years.

- Asset Finance – This is for businesses who need a loan to purchase new or used movable assets.

- A bridging loan – A short-term loan for businesses which must be repaid within 12 months.

- A revolving loan – A line of credit that businesses can use whenever it’s needed. These are only given to existing SEFA clients and must be repaid within 12 months.

- A Term Loan – This is for businesses who need to purchase moveable assets that don’t have serial numbers to identify it, e.g office furniture, fixtures and fittings. The repayment period for this loan is between 12 – 60 months.

Merchant Capital offers alternative small business funding. They believe that each business is unique, so they create customised loan packages for each business.

Types of funding: A cash advance

How the application works: Apply online or in person at one of their branches. They’ll review your application, and (if successful) you’ll receive funding within 48 hours.

Amount: Businesses can qualify for 100% of their credit and debit card average monthly turnover. But the final amount will be determined after your application has been assessed.

Requirements: To qualify for a cash advance, you must be a South African citizen or have a guarantor, have R80 000 in card sales or R150 000 in EFT transactions per month, and your business must have been trading for 12 months.

Repayment terms: Merchant Capital offers two types of repayment options – Split Processing or Daily Debit Order.

Split Processing is when repayments occur each time a transaction is processed on your card terminal. You’ll decide beforehand on a percentage that gets deducted from each card payment, so each time a card payment is processed, that percentage will go towards your repayment. The perk here is that if you don’t get paid, you don’t pay.

Alternatively, choose a set amount to get debited from your account every day.

Documents needed: During the application process, you’ll need to submit your average monthly turnover based on the following three categories: your EFT turnover, cash turnover and debit and credit card turnover. You’ll also need to add your business bank account and card machine details.

Costs: Costs are tailored to each business owner and are based on your application.

Apply here: https://www.merchantcapital.co.za/

The NYDA Grant Programme was created to provide young entrepreneurs with financial and non-financial business development support. With this support, young entrepreneurs can start or grow their businesses.

What the funding is for: You can use the funding to purchase assets, renovate your shop, or use it for working capital.

Amount: Apply for anything between R1000 and R200 000. Businesses related to agriculture or technology can apply for up to R250 000.

Requirements: You need to be a South African citizen and resident between 18-35. Successful applicants must participate in the NYDA Mentorship and Voucher Programme for 2 years. Anyone undergoing debt administration won’t be eligible to apply.

How the application works: Submit all required documents at a branch. You’ll also need proof of attending a Business Management Training course. The Your application will be processed within 30 working days. Along with your written application, you’ll also need to do a Business Pitch presentation – either in person or telephonically. The NYDA will also conduct a credit check and a due diligence assessment on your business.

Documents needed: You will need to submit a copy of your SA ID, proof of residence, a business plan, your business bank account details and quotations of what you need the funding for.

Repayment: Since this is not a loan, no repayment is required.

Read more: 6 ways SnapScan can help your business collect payments

Lulalalend provides business funding through a variety of direct lending products. The alternative lender offers Bridging Finance, Credit Facility, Equipment Financing, Inventory Financing, Trade Credit Facilities, Refinancing.

How it works: Apply for funding via Lulalend’s online platform. After submitting the necessary documents, your application will be reviewed. Lulalend uses its scoring technology to assess your risk to provide you with feedback in minutes. If approved, the funds will be in your business’s bank account within 24hours.

Amount: You can apply for anything between R10 000 to R5 000 000

Requirements: Your business must have been trading for one year, with an annual turnover of R500 000

Repayment terms: You can start repaying as soon as you like, within a 60 day period. Repay in standard instalments over six or 12 months. You’ll pay ⅙ or 1/12 of the amount depending on your chosen plan. You can also repay in full early without incurring any penalties. Use this to calculate your repayments.

Documents needed: You’ll need to submit three months’ bank statements. Lulalend recommends linking your online banking info to speed up the approval process.

Monthly costs: Based on your repayment plan, you’ll be charged between 2 and 6% of your loan amount for the first 2 or 4 months, followed by 2% for the rest of your repayment period.

Apply here: https://www.lulalend.co.za/business-funding

FinFind is an online lending platform that helps small business owners find funding. The platform matches businesses with financial institutions that are the most likely to provide them with funding.

How it works: Like popular dating sites, you’ll have to create an owner and company profile so FinFind can find you the most appropriate funding source. Once you’ve filled in all the required info, you’ll be notified of where you can apply.

FinFind takes the hassle out of finding the right place for you to apply. The three main benefits of creating a profile with them are:

- It’s an excellent place to store all the documents funders want from you. Most funders ask for similar documents – keeping them all in one place means you won’t have to look for them each time.

- You can get your credit report from them, and FinFind will provide you with tips on how to improve it.

- They’ll also provide you with all the necessary tips and tools to apply for funding to improve your chances of successfully getting the money you need to grow your business.

The National Empowerment Fund has seven different programmes designed to provide black-owned businesses with funding ranging from R250 000 to R75 million. This includes funds aimed toward women-owned businesses, businesses relating to Arts and Culture,, and businesses that operate in the tourism industry.

You can also check out the programmes spearheaded by the Department of Trade and Industry. Each programme is tailored towards a specific industry, so your best chance of qualifying is to find the one that matches your business.

Each of these funding types has its own set of pros and cons. It’s essential for you to carefully consider exactly what you’ll need to do to receive business funding.

Our advice? Apply for those that best match your business. That way, you can ensure that the process goes smoothly. And with the variety of options available, you’re sure to find a funder to help you grow your business.

Related articles

10 side hustle ideas you can turn into a small business

Use your skills to help you earn some extra income

16 (mostly) free online tools that’ll help you grow your small business

Use these nifty tools to drive your business forward.

6 factors you should consider when starting a business

Use these tips to turn your idea into an operating business.